PPI to collaborate with Purdue on analysis of Indiana’s $500 million economic development efforts

Indiana University Public Policy Institute and Purdue Center for Regional Development will examine regional impact of state’s READI program.

Media members: our experts are available to discuss our research and other stories related to our areas of expertise.

For media inquiries and interview requests, please contact Leslie Wells at 317-278-9670 or wellsle@iu.edu.

PPI to collaborate with Purdue on analysis of Indiana’s $500 million economic development efforts

Indiana University Public Policy Institute and Purdue Center for Regional Development will examine regional impact of state’s READI program.

Monroe County prosecutor honored for work promoting equitable justice

The Indiana University Public Policy Institute has selected Monroe County Prosecuting Attorney Erika Oliphant for its 2023 John L. Krauss Award for Public Policy Innovation for her work to promote equitable justice in Monroe County. The Krauss Award is given to an individual or entity for applied research or activity that helps Indiana and/or Indiana communities with real-world solutions.

Analysis finds more research needed on impact of maternal incarceration on children

Children whose mothers are behind bars are highly susceptible to long-lasting health and behavioral challenges. As the number of incarcerated mothers climbs, the Center for Health and Justice Research analyzed the impact on children and provided recommendations to improve conditions for incarcerated mothers and their children.

Policy recommendations to address affordable housing issues in Indiana

In Indiana, the shortage of affordable and available housing has grown in recent years. Researchers from the Center for Research on Inclusion and Social Policy provide suggestions for addressing the problem.

Addressing unequal access to energy in Indiana

Indiana is making efforts to shift to more clean and renewable energy sources, while also attempting to expand access to these services.

CRISP researchers provide recommendations to address maternal mortality in Indiana

Indiana has the third-highest maternal mortality rate in the country. Learn more about recommendations from CRISP researchers on how to address the problem.

Researchers offer solutions to refugee resettlement barriers

Refugees resettling in Indiana face barriers to success. Read more about the implications of those challenges and possible solutions to reducing those barriers in the latest policy brief from the Center for Research on Inclusion and Social Policy.

New report outlines policy solutions to address homelessness

A new policy brief from the Center for Research on Inclusion and Social Policy examines homelessness in Marion County, Indiana, and provides policy solutions to help address the issues that cause homelessness.

2022 Point-in-Time Count: Homeless in Indianapolis

For more than a decade, the IU Public Policy Institute (PPI) and the Coalition for Homelessness Interventionand Prevention (CHIP) have collaborated with local organizations to conduct Marion County’s annual Point-in-Time (PIT) Count. As mandated by the U.S. Department of Housing and Urban Development (HUD), the PIT Count reports the number of people experiencing homelessness on a single night in January. This report highlights key findings and takeaways from the PIT Count to inform policy decisions and service provision.

New report assesses disparities in the bail bond system

Following the passage of Indiana's new bill governing charitable bail bond organizations, the CRISP research team examined the bail bond system and Indiana HEA 1300's potential impact on defendants. Learn more about the bail bond system's effect on racial disparities within the criminal justice system and efforts to reform the use of bail bonds in this latest policy brief from the Center for Research on Inclusion and Social Policy.

PPI presents John Krauss Award to Indianapolis City-County Council

PPI bestowed the biennial award to the Indianapolis-Marion County City-County Council for its efforts to improve service and responsiveness to its constituents.

2021 Point-in-Time Count survey provides glimpse into homelessness in Indianapolis

For more than a decade, the IU Public Policy Institute and the Coalition for Homelessness Intervention and Prevention have worked with local organizations to conduct Marion County’s annual Point-In-Time Count. The PIT Count provides a critical glimpse into Indianapolis’ homeless community and serves as a resource for policy makers and leaders to learn about the people who make up this population.

Creating equitable economic growth in Indianapolis

Analysts at the Center for Research on Inclusion and Social Policy created a new framework for economic growth in Indianapolis. Read more about the plan that focuses on growing an economy through equity and inclusion.

Thruston named interim director for Center for Research on Inclusion and Social Policy

Learn more about CRISP's new interim director, Wanda Thruston, a clinical assistant professor and special assistant to the Dean for Diversity, Equity, and Inclusion at the IU School of Nursing in Indianapolis.

New evaluation examines township assistance in Marion County

A new analysis of township assistance programs in Marion County, Indiana, looks at how township assistance funding is distributed to those in need, examines trends from 2011 through 2019, and makes recommendations on how the program can better serve local residents. Read the full report for detailed township-level data on township assistance practices and outcomes.

Affordable housing, internet connectivity, and drug abuse among challenges for Indiana communities

The 2020 survey of local elected officials found that leaders across the state are optimistic about their communities' futures despite the many challenges they say their communities face.

New study examines impact of COVID-19 on Indiana jails

A new study from the Center for Health and Justice Research at the IU Public Policy Institute found that changes made in 2020 due to COVID-19 reduced jail populations across Indiana and may have long-term impacts on jail operations.

Great Families 2020's impact on organizations

In 2016, the United Way of Central Indiana started its Great Families 2020 initiative as a way to promote a two-generational approach in helping families in Indianapolis. The first of three brief examines how participating organizations felt about the program.

Black, Latinx communities in Marion County disproportionately affected by evictions

A new analysis of eviction trends in Marion County, Indiana, found significant disparities for minority communities. From January 2015 through December 2019, Black and Hispanic/Latinx communities in Marion County consistently experienced significantly higher eviction rates.

Manufacturing Policy Institute names Sameeksha Desai as new director

O'Neill School Associate Professor Sameeksha Desai has been named the new director for the Manufacturing Policy Institute.

PPI led a team of researchers to create a report that analyzes the impact the impending closures and partial closures of four coal-fired generating plants—Schahfer (Jasper County), Michigan City, Petersburg, and Rockport—will have on communities in Indiana.

Analysis evaluates mobile crisis teams addressing overdose epidemic in rural Indiana

Addressing the overdose epidemic still plaguing Indiana requires a holistic approach from teams that combine different disciplines. New analysis from the Center for Health and Justice Research (CHJR) at the IU Public Policy Institute looks at what challenges these teams face, what can help them be successful, and best practice recommendations that can ensure these teams are ready to help Hoosiers trapped in addiction.

New study finds voting machines in Indiana are vulnerable to security issues

Indiana is one of only eight states that will use paperless voting machines in the November 2020 elections. Yet new analysis from the IU Public Policy Institute finds that the state’s reliance on older paperless voting machines could pose security risks in the upcoming election.

Indiana Prison Writers Workshop provides creative outlet for inmates

A new CHJR evaluation finds prison writing programs provide benefits for inmates and facilities alike.

Candidates for Indiana governor discuss policy issues impacting Hoosiers

WFYI and other Indiana Public Broadcasting Stations will air PPI's third gubernatorial forum throughout September and October ahead of the general election on November 3.

Marion County’s minority residents face barriers to home loans

New analysis from PPI finds that minority residents in Marion County face barriers to acquiring home purchase loans, refinancing, and home improvement loans, especially for those living in majority-Black neighborhoods.

Homelessness in Indianapolis in 2020

CRISP researchers worked with the Coalition for Homelessness Intervention and Prevention (CHIP) to conduct its annual report about the state of homelessness and homeless populations in Indianapolis.

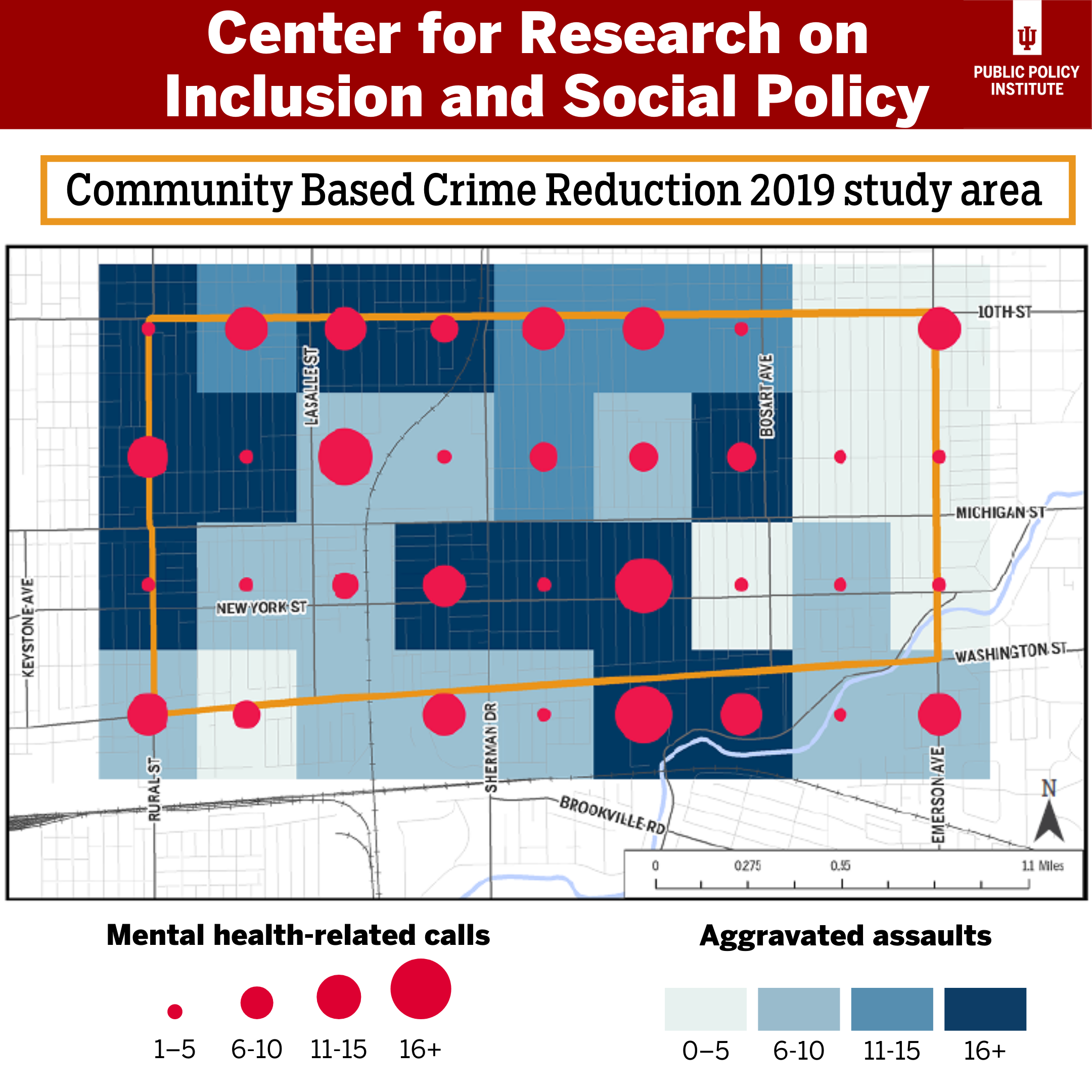

Substance abuse, mental health, and crime on Indianapolis' Near Eastside

Analysis of how residents, faith-based leaders, social service providers, and criminal justice professionals view crime and drivers of crime on the Near Eastside of Indianapolis.

COVID-19 and Immigration Policy: Implications of the public charge rule

CRISP researchers examine the impact the public charge rule may have on immigrant communities amid the COVID-19 pandemic.

New analysis looks at jail populations amid COVID-19 pandemic

Analysis from the Center on Health and Justice Research found U.S. jail populations dropped nearly 17 percent overall during the COVID-19 pandemic.

Analysis shows impact of COVID-19 stay-at-home orders on crime

Stay-at-home orders designed to minimize the spread of COVID-19 have a varying impact of crimes in Indianapolis.

PPI Director Tom Guevara discusses the 2020 recession

PPI Director Tom Guevara joined Tina Cosby on Community Connections to discuss the current recession and its impact.

CRISP Director Breanca Merritt discusses Indianapolis protests

CRISP Director Dr. Breanca Merritt, Ph.D., joins All IN radio show to discuss the role institutionalized racism plays in the current protest movement.

CRISP researchers examine institutional causes behind COVID-19 death disparities in Indiana

COVID-19 has resulted in a disproportionate number of deaths among black Hoosiers. These differences often have underlying causes that stem from institutional, structural, and social disparities.

Study focuses on City-County Council effectiveness

A five-month research study can position council to consider strategic changes that have the potential to foster performance in some areas and navigate barriers to effectiveness in others.

Black neighborhoods in Marion County face uphill battle against low home values

New analysis from the Center for Research on Inclusion and Social Policy sheds light on black homeownership and home values in Marion County’s predominately black neighborhoods. Homes in these areas are undervalued when compared to homes in neighborhoods with few or no black residents.

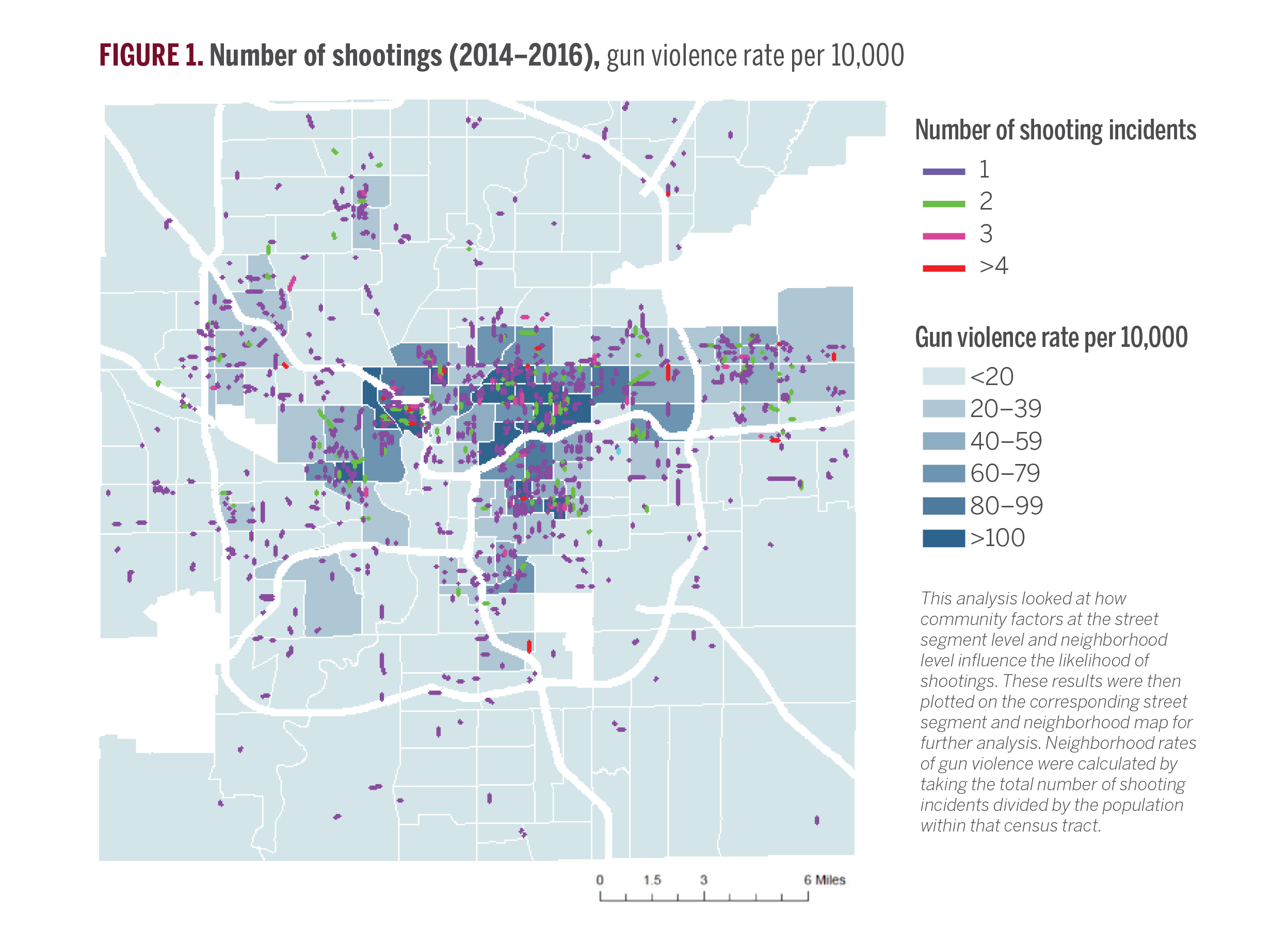

Analysis examines gun violence in Indianapolis

Analysis of gun violence in Indianapolis (2014-2016) provides a better understanding of where shootings happened and the social factors at play.

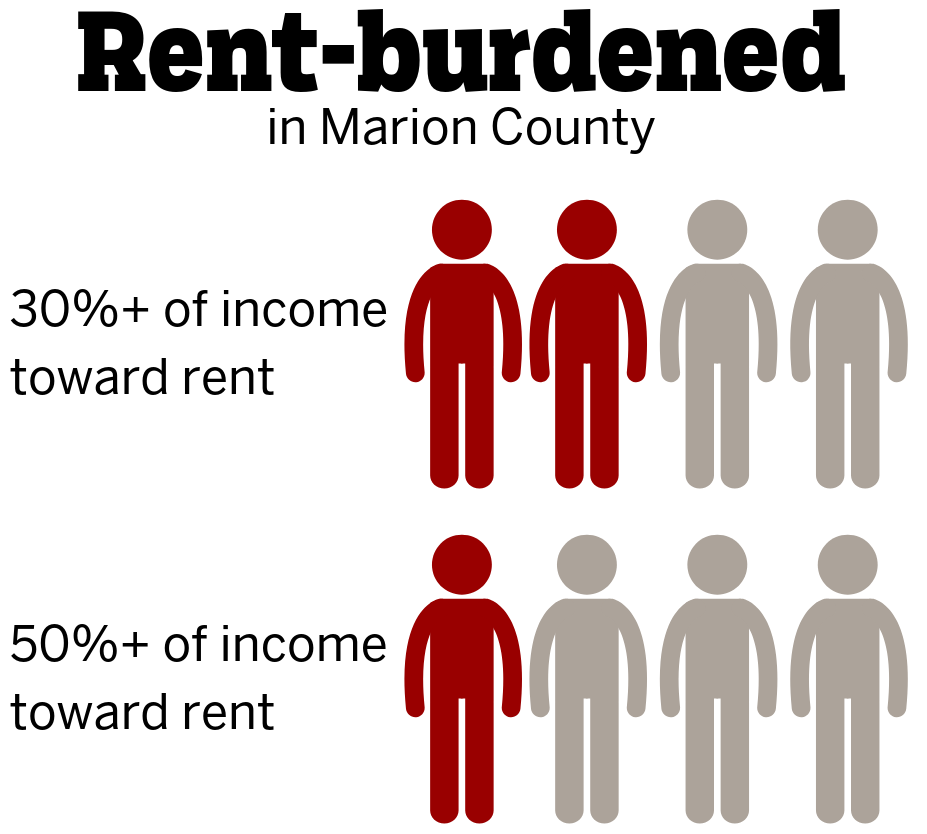

Marion County renters struggle with affordability

CRISP’s analysts examined data on housing instability in Marion County and found many renters struggle with low wages and high rent burden.

Grommon named interim director for Center for Health and Justice Research

Eric Grommon, an associate professor at the O’Neill School of Public and Environmental Affairs, has been named the interim director of the Center for Health and Justice Research at the Indiana University Public Policy Institute.

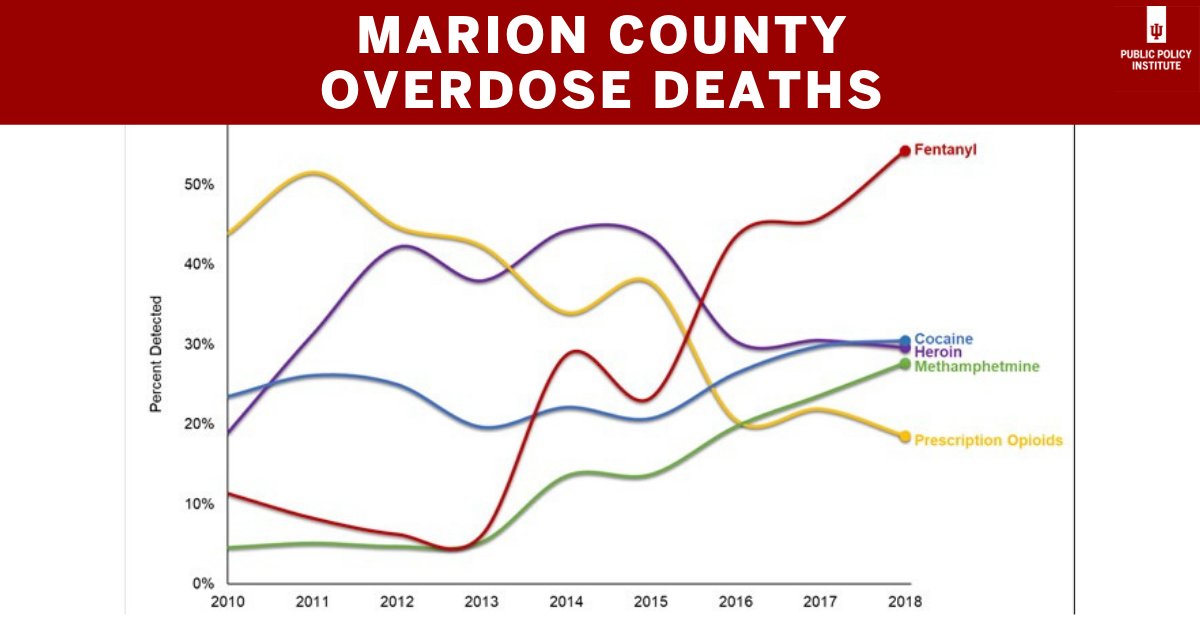

New numbers show drop in overdose deaths in Marion County

New data from the IU Public Policy Institute’s Center for Health and Justice Research shows a drop in the number of accidental overdose deaths in Marion County, including those that were opioid-related. Despite that decline, opioids were still present in 78 percent of the county’s 361 overdose deaths in 2018.

Marion County has third-highest eviction rate in Indiana

CRISP analysts look at eviction trends, the impact of those trends, and recommendations to address Marion County, Indiana's high eviction rates.

Youth mentoring program addresses needs of Indianapolis refugee youth

PPI partnered with the Immigrant Welcome Center and several IUPUI schools and offices to develop the program, which is designed to help students build the skills and connections necessary to thrive in their new community and to envision a path to college after completing high school.

New research released ahead of hate crimes bill debate in Indiana legislature

Findings have policy implications that policymakers should consider, including the fact that effectiveness of bias crime legislation should be further evaluated for impact and operation.

PPI launches Center for Research on Inclusion & Social Policy

The Center for Research on Inclusion and Social Policy will focus on informing and educating the public about the many factors of social policy.

IU Center for Criminal Justice Research updates name to Center for Health & Justice Research

Center director Brad Ray says the new name will better reflect the center’s work, while ensuring it doesn’t contribute to the stigmatization of the populations involved in that work.

Growing economies of Hoosier micropolitan areas will be focus of policy forum open to the public

The Indiana University Public Policy Institute and The National Academies of Sciences, Engineering, and Medicine will host a policy forum and workshop April 25 that will focus on how to expand economies and innovation-led job growth in smaller communities in Indiana.

PPI senior analyst to give keynote at Columbus Chamber annual meeting

Drew Klacik, a senior policy analyst with the Indiana University Public Policy Institute, will be keynote speaker at the 109th Columbus Area Chamber of Commerce annual meeting, 11:30 a.m. to 1:30 p.m. March 28 at The Commons in downtown Columbus.

Local government officials remain unaware of 211 service line’s popularity with Hoosiers

A new report from Indiana University examines what community leaders such as mayors, county commissioners, and city and county council members know about the 211 service in Indiana. Despite the availability of the 211 service in all 92 Indiana counties, only 39 percent of local government officials are aware of its existence.

Review shows program for offenders with mental health or addiction issues produces positive results

A review of a state program launched two years ago to improve recovery and reduce recidivism among felony offenders who have mental health or addiction issues shows the program is producing positive results.

PPI to celebrate 25 years of serving Hoosiers with special daylong symposium and celebration

The Indiana University Public Policy Institute is holding a special symposium and reception to celebrate 25 years of helping decision makers across the state effect change and a better quality of life for Hoosiers.