Fuel Economy Standards and the U.S. Economy

Nikos Ziroglannis, Sanya Carley, Denvil Duncan, Saba Siddiki, and John D. Graham

In 2016, the transportation sector became the leading emitter of greenhouse gasses (GHG) among all sectors of the U.S. economy, surpassing the electricity sector for the first time. Within the transportation sector, the majority of GHG emissions (about 60 percent) come from the light-duty vehicle (LDV) fleet, which consists of cars and light trucks, the vehicles in the U.S. economy that consume most of the oil. Recognizing the importance of the LDV fleet and its contribution to climate change and oil dependence, the federal government in 2012 updated the Corporate Average Fuel Economy (CAFE) standards and paired them with greenhouse gas emission standards, setting a goal of 54.5 miles per gallon for LDVs by model year 20251. At the same time, the Zero Emission Vehicle (ZEV) mandate of the California Air Resources Board (CARB), which has now been adopted by nine other states, set an increased sales requirement for electric vehicles in those states2. These combined federal and state regulations present an ambitious challenge for the U.S. automobile sector and have important implications for the U.S. economy.

In 2015, a team of faculty in the Indiana University School of Public and Environmental Affairs was commissioned by the Alliance of Automobile Manufacturers to examine the macroeconomic effects of the combined standards. Our results can be summarized in two key findings:

1) The automotive sector is a large enough part of the U.S. economy that the combined standards will cause short-term decline in key economic indicators, but after 2025, the economy will start to show gains that will increase over time.

2) There are significant uncertainties with respect to the impact that the standards will have on sales of new vehicles, mostly due to the value consumers place on fuel savings resulting from the standards.

Key causal mechanisms that link the combined standards to US economic performance

Our work addressed three key causal pathways through which the standards could affect the U.S. economy, namely: (1) the price premium for fuel efficient and electric vehicles; (2) the boost to the automotive supply chain from investments in fuel-saving technologies; and (3) the mixed effects on the cost savings resulting from reductions in gasoline consumption that stimulate consumer spending versus the curtailment of U.S. oil production. The study quantifies each of these causal mechanisms separately and then models their combined effects from 2017 to 2035 and thereafter.

How do consumers weigh a vehicle-price increase against fuel savings over the life of the vehicle?

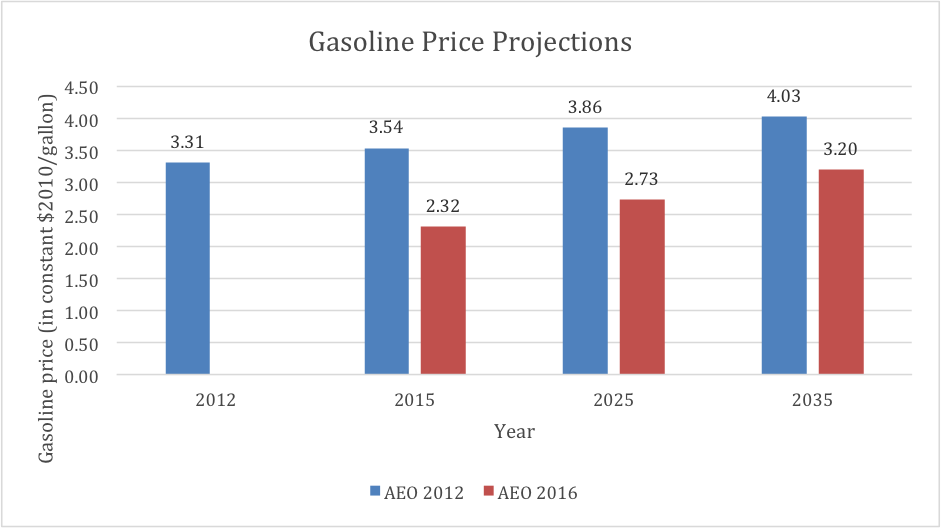

In order to comply with the standards, manufacturers will have to invest in new technologies that are expensive and will likely increase the sale price of LDVs. An important effect that is still undetermined is the size of that price increase. When the standards were finalized in 2012 the National Highway Traffic Safety Administration (NHTSA) estimated that the price premium for the average LDV in model year 2025 would be $1,4611. However, a 2015 report by the National Research Council found that, for the typical midsize car, the price increase could be either 11 percent or 55 percent higher than what NHTSA predicted in 20123. This is a substantial increase that, if applied to other types of vehicles and passed on to consumers, could burden new-vehicle buyers. The majority of the benefits from the combined standards are derived from savings to motorists from reduced gasoline expenditures. The size of the cost savings depends in part on how fuel prices evolve in the future. Over the past few years changes in the international oil markets have brought a significant decline in gas prices (see Figure 1), thus decreasing the projected fuel savings that car owners will experience compared to the 2012 projections.

This issue of gasoline savings is further complicated because consumers do not value fuel savings over the entire life of the vehicle, which averages about 16 years. While new car buyers currently hold on to their car for an average of seven years, evidence shows that some consumers only consider one to three years of fuel savings when deciding which car to buy3. If that undervaluation is the norm, then the price increase due to the standards could significantly hurt new cars sales and compromise the goals of the standards.

Figure 1: Comparison of fuel price projections between Annual Energy Outlook (AEO) 2012 and AEO 2016 (in constant 2010 $/gallon)7,8.

Our analysis

Our research examined a series of alternative scenarios that help convey the extent of uncertainty about the macroeconomic outcomes. Our results are classified in two main categories: (1) the effects of the standards on key macroeconomic indicators such as Gross Domestic Product (GDP), employment and disposable income; and (2) the trajectories of new car and light truck sales4.

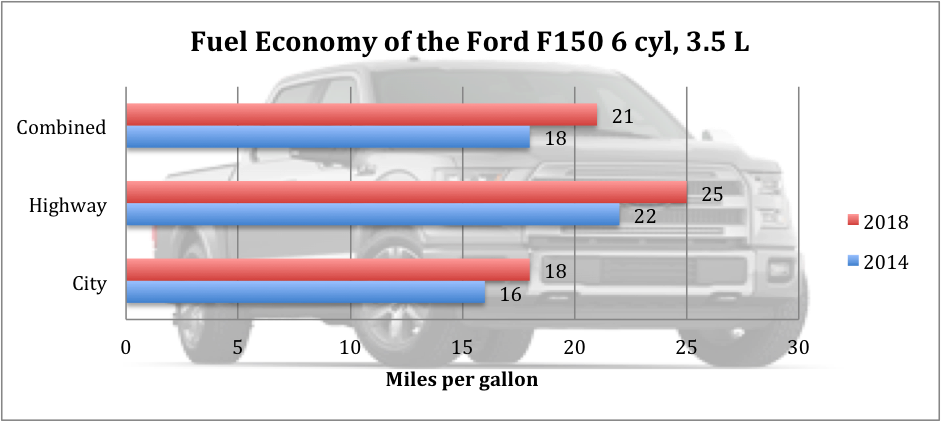

The macroeconomic results suggest that the standards will have a negative impact in the U.S. economy in the early years (i.e. 2017 to 2023-2025)[1]. However, as more fuel-efficient vehicles enter the fleet (see Figure 2) and the gasoline savings start accumulating at an increasing rate, the economy will experience a beneficial boost through increases in disposable income that will further boost employment and GDP. Most of the scenarios we examined indicate that the cumulative economic impacts from the standards over the period 2017-2035 will be positive.

We also performed a simulation of changes in the volume of new-vehicle sales using a total-cost-of-ownership method that accounts for changes in the costs of vehicle operation and vehicle price. Our results indicate a range of expected outcomes, with sales in model year 2025 for new vehicles varying from -10% to +4% compared to the baseline. This range highlights the significant uncertainty that exists around new sales volumes, but most of our updated modeling shows negative impacts on new vehicle sales. A slower volume of new vehicle sales is important economically since it can have adverse effect in employment and GDP growth. In addition, it reduces the effectiveness of the standards by compromising the goal of decreasing oil consumption and emissions of GHGs.

Figure 2: Comparison of fuel economy data for the 2014 and 2018 Ford F150 Pickup 2WD 6 cyl, 3.5 L, automatic. Fuel economy expressed in miles per gallon.9, 10, 11

What is next for the combined standards?

Our work highlights several key points about the future effects of the combined standards. These points summarize our recommendations:

- In the long term (past 2025) the federal standards will likely yield benefits to the U.S. economy and thus our report provides evidence supporting retention of the federal standards. However, there are potential refinements to the standards or to related policies that, if implemented, could attenuate the near-term economic damages while increasing program effectiveness.

- There is a need for more research in the way consumers value fuel economy in the markets for used and new vehicles. Currently most of the economics literature addresses this question by using variation in fuel prices as a mechanism to identify consumers’ valuation of fuel economy 5,6. However, in the context of CAFE what is more important is the extent to which consumers value fuel efficient technologies mandated by regulation. Consumers’ valuation of fuel efficient vehicles is, of course, affected by fuel prices, however, the current literature cannot isolate how consumers value specific fuel efficient technologies. Research directed at addressing this question would be well positioned to inform policy making by helping to understand how likely consumers are to respond to the new technologies stimulated by regulation.

Peer reviewers: Arthur G. Fraas, Visiting Fellow, Resources for the Future, and Jeffrey R. Holmstead, Partner, Bracewell LLP

[1] A detailed analysis of the results is provided in Carley et al. (2017). All results are based on a net present value analysis.