Providing for the Common Defense

Download as PDF

Raeanna L. Carrell and Keith B. Belton

The U.S. Department of Defense (DoD) has always relied upon, to some extent, supplies of strategic natural resources and manufactured goods from foreign nations. A 21st century problem, however, is dependence on strategic competitor nations—those nations (e.g., Russia and China) that aim to upset the current international order and, more specifically, undercut U.S. global preeminence.

The U.S. is heavily reliant on China for its supply and processing of rare earth elements, a natural resource that is integral to modern technologies, including defense technologies. Rare earths, therefore, represent a case study of foreign dependence. If the U.S. can successfully lower the national security risk of foreign dependency for rare earths, then it can successfully manage other cases of foreign dependence that are less critical. Our review of U.S. options suggests that the threat from China is relatively tractable.

The Significance of Rare Earths

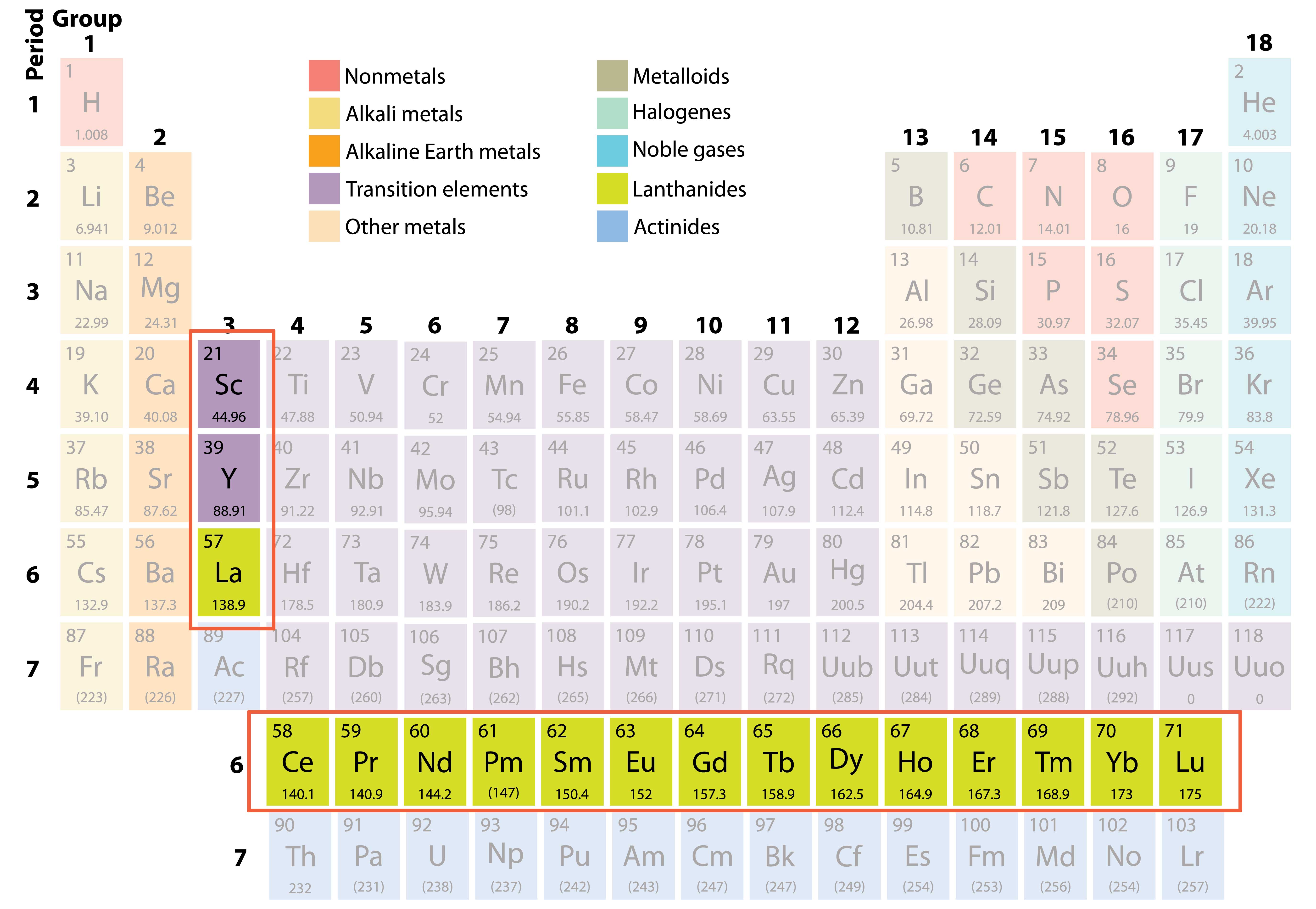

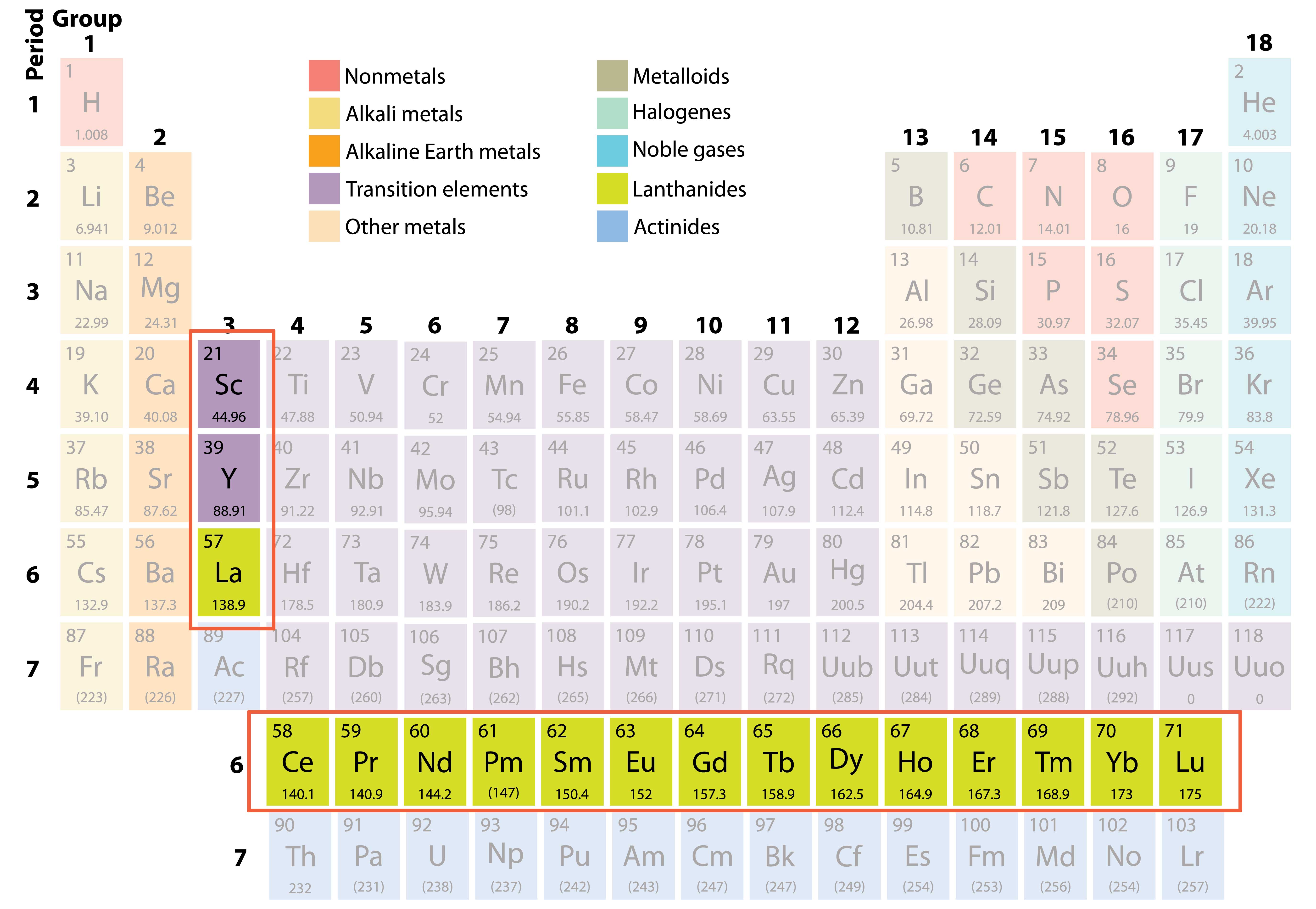

Rare Earth Elements (REEs)—a set of 17 metallic elements in the periodic table (Figure 1)—are widely found in nature, but seldom in mineable concentrations. Mining and processing of REEs is therefore relatively costly, in both environmental and economic terms. However, due to their unique magnetic, luminescent, and electrochemical properties, rare earths are indispensable across a wide range of technologies.

Figure 1. The 17 rare earth elements. Source: Rare Earth Element Resources.

Table 1 shows global consumption patterns. The largest and fastest growing segment is permanent magnets, used in computation and communications products, including strategic applications in the aerospace and defense industries (e.g., jet engines, missile guidance systems, lasers, and satellites).

Table 1. Global Consumption of Rare Earth Oxides by End Use.

Segment | % of 2012 Consumption (121 tons) | % of 2016 Consumption (159 tons) |

Permanent Magnets | 20 | 31 |

Catalysis | 20 | 18 |

Metallurgical alloys | 19 | 18 |

Glass and ceramics | 12 | 11 |

Polishing powders | 15 | 13 |

Light phosphors | 7 | 4 |

Other | 7 | 5 |

Source: Dominique Guyonnet, Gaetan Lefebvre, and Nourredine Menab, Rare Earth Elements and High-Tech Products, Circular Economy Coalition for Europe, 2018, and taken from Roskill, Rare Earths: Global Markets, Industry, and Outlook 2015.

China’s Market Power

In the 1980s, China scaled up its rare earth mining and processing capabilities. The result of this strategic effort is that China now has a near-monopoly on both the mining of rare earth minerals and the processing of the resultant rare earth oxides into manufactured products. Many experts attribute China’s dominant market share to low labor costs, low environmental standards, and its state-directed investment strategy. In China, production and mining are largely controlled by state-owned enterprises, giving China’s government effective control over global supply.

According to statistics from the U.S. Geological Survey, in 2018 China was responsible for 71% of global REE production. Between 2014 and 2017, 80% of U.S. imports came from China, while the remaining 20% was originally processed in China. For particular steps in the processing of REE—for example, the metallurgical transformation of rare earth oxides into finished parts—China has a near-complete monopoly.

Because of its market power, China poses a potential threat to U.S. national defense. This threat was on full display in 2010, when China embargoed REEs to Japan in response to a maritime dispute over the Senkaku Islands in the South China Sea. This supply disruption had spillover effects in the United States, which relies on Japan for the procurement of permanent magnets and other goods made with REE components. The 2010 embargo lasted for nearly two months. In that time, Japan experienced significant shortages, China refused to increase REE exports to any other country to make up for the gap in supply, and the global price of REEs spiked nearly ten times its pre-embargo price.

By the end of 2010, prices tumbled as the market adjusted and other nations reclaimed the ability to produce their own supply of REE-based products. Japan developed a method for recycling rare earth elements from used electronics. In the United States., the Mountain Pass Mine in California resumed operation (it closed again in late 2015 before reopening in 2018). Manufacturers also started substituting other materials for rare earths into their products. The United States, followed by the European Union and Mexico, filed a WTO case against China, alleging that its rare earth export quotas violated international trade rules. The WTO agreed, mandating that China abandon the practice.

The 2010 embargo demonstrated that (1) China can very quickly create a supply shock, and (2) global markets can respond to such a shock by both reducing demand and developing their own mining capacities in a relatively short period of time. Nevertheless, China still retains a near-monopoly on processing of REE, especially the process of transforming rare earth oxides into finished metal parts—a process step that is only economical at a significant scale.

In recent months, China has made implicit threats to use rare earths as a weapon in the ongoing trade war between the United States and China. The U.S. government is not sitting still. President Trump recently issued presidential determinations that trigger DoD action regarding certain REE-enabled products (e.g., permanent magnets).

Because of its market power, China poses a potential threat to U.S. national defense. This threat was on full display in 2010, when China embargoed REEs to Japan in response to a maritime dispute over the Senkaku Islands in the South China Sea. This supply disruption had spillover effects in the United States, which relies on Japan for the procurement of permanent magnets and other goods made with REE components. The 2010 embargo lasted for nearly two months. In that time, Japan experienced significant shortages, China refused to increase REE exports to any other country to make up for the gap in supply, and the global price of REEs spiked nearly ten times its pre-embargo price.

By the end of 2010, prices tumbled as the market adjusted and other nations reclaimed the ability to produce their own supply of REE-based products. Japan developed a method for recycling rare earth elements from used electronics. In the United States., the Mountain Pass Mine in California resumed operation (it closed again in late 2015 before reopening in 2018). Manufacturers also started substituting other materials for rare earths into their products. The United States, followed by the European Union and Mexico, filed a WTO case against China, alleging that its rare earth export quotas violated international trade rules. The WTO agreed, mandating that China abandon the practice.

Policy Options and Strategy Formulation

How can the U.S. government enhance its resiliency to future supply shocks from China or other nations who wish to use the supply of a critical strategic mineral as a weapon? A review of government reports and the academic literature suggest a strategy can be crafted from four options:

- Maintain the status quo (for non-critical applications where substitutes are adequate)

- Develop a domestic supply capability (including metallurgy)

- Partner with strategic allies to share and reduce cost, and

- Innovate (including through recycling of REEs from waste materials)

These discrete options can be used as building blocks for crafting a comprehensive U.S. strategy, the goal of which should be to increase the resiliency of the defense industrial base to a future supply shock from competing nations (i.e., the threat scenario).

Strategy development can be conceptualized as a four-step sequence: (1) prioritization by element and application (e.g., neodymium in permanent magnets used in certain defense applications might be designated as high priority); (2) for each high-priority application, a qualitative identification of opportunity cost (i.e., the next best alternative to the status quo in case of a supply shock); (3) identification of major uncertainties combined with a value-of-information (VOI) analysis to ensure robust results under step 2; and finally, (4) strategy formulation by combining the chosen options across the high-priority applications.

Before beginning such an exercise, the threat scenario should be clearly defined. For example, a plausible scenario might be a repeat of the 2010 Senkaku Islands incident, in terms of both the actions China might take and the global market reaction that was observed. Another example would be if a Chinese supplier were to decline to produce and export a finished part necessary for US national security. Once the threat scenario is identified, the strategy development process can proceed.

Under step 2 (defining opportunity cost), experts should be consulted to examine each high-priority application. For example, the experts may decide that neodymium permanent magnets are an irreplaceable product necessary in missile defense, and the best response would be for the United States to create its own capability to transform the rare earth oxide into the finished part.

In cases where uncertainty is high and the opportunity cost is highly variable, it may be useful to commit a small amount of resources for information gathering. VOI analysis is a decisional tool employed in such cases and should be employed here.

The resulting strategy would be a compendium of actions that could minimize opportunity costs across all high-priority applications. Evolving geopolitical and commercial realities will need to be accommodated into the strategy, which should be revised periodically. The basic approach described here could be altered to provide greater specificity or provide a range of strategic options dependent upon resource levels and/or multiple threat scenarios.

Publicly available information suggests that such an approach is currently being employed by DoD. The Department has prioritized applications, and the listed policy options are being considered and chosen based on priority.

Conclusion

The 2010 Senkaku Islands Dispute provides an illustration as to China’s relatively limited ability to restrict global access to a critical strategic mineral over a sustained period of time. This experience also provides a very specific scenario under which DoD can develop a strategy to improve U.S. resiliency from a future supply shock.

Key to adequate preparation is analysis of the most critical REE applications and a determination of which mix of options would best lower the opportunity cost. Use of VOI analysis can help reduce uncertainty in the most cost-effective manner and assist in strategy development.

The relative tractability of this issue, a critical case of foreign sourcing, bodes well for U.S. national security in an age when the industrial defense base is dependent on complex global value chains.

Raeanna L. Carrell is a first-year law student at the Indiana University Maurer School of Law. Keith B. Belton is Director of the Manufacturing Initiative at Indiana University.

Peer Reviewers: Dean L. Bartles, President and CEO, National Center for Defense Manufacturing and Machining, and J. J. Brown, President, ThinkPolicy Consulting.

For Further Reading:

Grasso, Valerie Bailey. 2013. Rare Earth Elements in National Defense: Background, Oversight Issues, and Options for Congress. Congressional Research Service, December.

Guyonnet, Dominique, Gaetan Lefebvre and Nourredine Menab, Rare Earth Elements and High-Tech Products, Circular Economy Coalition for Europe, 2018.

US Department of Commerce: 2019. A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals, June.

US Department of Defense. 2018. Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States. September.

Vekasi, Kristin. 2019. "Politics, Markets, and Rare Earth Commodities: Responses to China's Rare Earth Policy." Japanese Journal of Political Science 20: 2-20.