Why China Leads the World in Plug-In Electric Vehicles

Download as PDF

John D. Graham, Keith B. Belton, and Suri Xia

The rise of China has been the defining feature of the 21st century global economy. In a globalizing marketplace, China’s low-cost labor became a huge attractor of foreign direct investment. This advantage, combined with a growing domestic market, increasing technological know-how and world-class infrastructure suitable for shipping goods anywhere in the world, has made China “the world’s factory.”

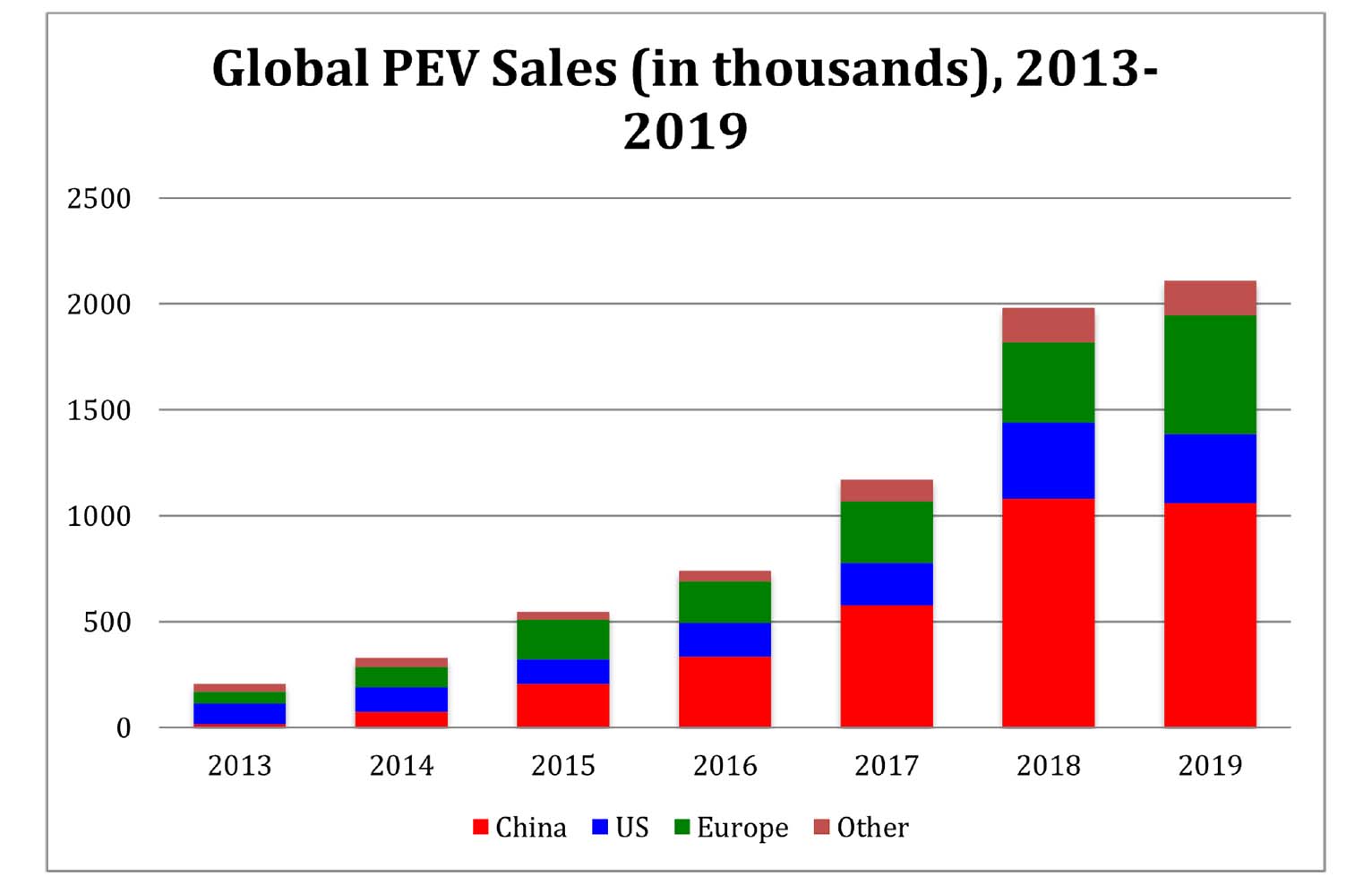

Public policy also played a key role, as exemplified by policies promoting plug-in electric vehicles (PEVs), a category that includes purely battery electric vehicles (BEVs), plug-in hybrid vehicles (PHEVs), and hydrogen fuel-cell electric vehicles (FCVs). PEVs offer significant promise as a partial solution to climate change and local air pollution and a platform for self-driving cars and ride sharing. In the last seven years, China surpassed the United States as the world leader in PEV production and sales (Figure 1).

China’s Strategic Approach

For decades, Chinese economic planners craved a domestic auto industry that was globally competitive, exporting vehicles and parts to countries around the world while also meeting the growing needs of Chinese consumers. China is openly envious of what General Motors did for the United States, what Volkswagen did for Germany, and what Toyota did for Japan.

But China’s Ministry of Science and Technology was convinced that China had little hope of competing with Japan, Korea, Germany and the United States in the conventional auto market. The Ministry’s 863 Program, an applied R&D program dating back to 1986 and involving Chinese automakers, suppliers, universities, and independent laboratories, shifted its focus to “New Energy Vehicles,” especially PEVs. China’s hope was to leapfrog over the established global automakers by securing a first-mover advantage on PEVs.

In 2000, the state of Chinese R&D on lithium ion batteries (LIBs) and electric drive systems was about 10 years behind that of Japan. Over the next five years, this gap was narrowed to less than two years, primarily due to the 863 Program, the rise of China in consumer electronics, and the emergence of BYD Company Ltd., a successful battery maker for consumer products.

A key feature of China’s advanced vehicle policy was nationwide subsidies for PEV purchasers. Central government and provincial subsidies combined range from $10,000 to $20,000 per vehicle, depending on the city and the PEV design. The subsidy program was coupled with four important changes in auto-sector policy that boosted the fortunes of Chinese firms.

First, the central government “requested” that foreign auto companies working in joint ventures with Chinese auto makers share PEV technology with Chinese automakers. The Obama administration complained that this policy was a violation of the terms of China’s 2001 entrance into the World Trade Organization (WTO). China disputed the allegation, emphasizing that it was a voluntary policy and not compulsory. The US never took the issue to the WTO.

Second, the central government, as well as provincial and city governments, made subsidies available only to companies assembling vehicles in China, which favored Chinese automakers. Foreign companies exporting PEVs to China, such as Tesla, were not only subject to China’s stiff 25% tariff on imported cars; they were also ineligible for PEV subsidies.

Third, Chinese automakers had to use an approved Chinese supplier of LIBs to qualify for PEV subsidies. Korean and Japanese battery producers, even though they were investing in Chinese facilities, were effectively excluded from the Chinese market for several years.

Finally, Chinese banks helped Chinese suppliers gain access to raw materials for LIBs and electric-motor production. China possesses some, but not all, of those key raw materials (e.g., lithium, cobalt, and neodymium). Chinese banks, working closely with the central government, enabled Chinese suppliers to acquire ownership interests in companies and mines everywhere from Australia and Africa to South America, North America, and Europe. China has thus developed considerable control over the most challenging links in its PEV supply chain, a distinct advantage over American and European competitors. Chinese companies now account for a majority of the global production of each of the key inputs to lithium ion batteries: anodes, cathodes, electrolytes and separators. Chinese companies also produce – or have ownership interests in – a majority of the raw materials and processing facilities at the beginning of the PEV supply chain.

When China’s multi-decade industrial policy, Made in China 2025, was published in 2015, it reaffirmed the pro-PEV policies implemented over the previous ten years. The original goal was to put 5 million PEVs on the road by 2020—2.5 million battery electric vehicles, and 2.5 million hybrid electric vehicles. Like the state of California and the US federal government, China later dropped promotion of hybrids (seen as a mature technology), and recast the national goal as 5 million PEVs by 2020.

Since then, the national goals for PEV deployment have been upgraded and extended to 2025, when PEV sales are expected to reach 3 million per year, 80% of which will be produced by domestic Chinese automakers. PEV subsidies extended far beyond the original $15 billion figure floated by Chinese officials; independent estimates from the Center for Strategic and International Studies place the cumulative amount, through 2018, at roughly $60 billion. This figure includes vehicle subsidies, foregone tax revenue, subsidies for charging infrastructure, and governmental R&D.

A Liberalization Trend

In 2015, China announced that it would gradually phase out subsidies for PEVs from 2016 to 2020 (since extended to 2022). Provincial and municipal subsidies must be phased out at the same pace as—and in proportion to—the central government subsidies. As the subsidies have been reduced, they have also been reformed to encourage advanced PEVs that have a longer, all-electric driving range. And greater investment is being made in charging infrastructure, especially “fast charging” along highways that connect the country’s eastern cities.

In April 2018, the central government announced a phasing out of long-standing requirements (since the 1990s) that compel foreign automakers, when working through joint ventures with Chinese auto makers, to share factory ownership and profits with Chinese corporate partners. Starting in 2018, foreign automakers making PEVs in China were not required to work with a Chinese automaker. By 2022, the joint venture regulations for all motor vehicles will be scrapped. The new policy has facilitated Tesla’s big entrance into the Chinese market, including a huge new facility in Shanghai’s free-trade zone.

Effective April 2018, a California-style “zero-emission vehicle” (ZEV) mandate became applicable to all automakers doing business in China. Each is now required to earn “credits” equal to 10% of their overall China sales in 2019 and 12% in 2020; those percentages are expected to rise significantly through 2030. The number of “new energy vehicle” credits varies based on whether the vehicle is a battery, plug-in hybrid, or other type of advanced vehicle.

Conclusion

China has successfully leveraged public policy to create the world’s largest domestic market for its PEVs. However, China has not yet demonstrated that it can produce PEVs that will sell in Europe, Japan, or the United States. China has demonstrated that it can dominate (or at least influence strongly) the global supply chain for PEVs, including LIBs, components, and raw materials. Chinese companies (e.g., BYD and battery maker CATL) will retain a competitive advantage globally because it will take their competitors substantial time and resources to compensate for the favoritism that Chinese companies enjoyed. In addition, the United States, Europe, and Japan have yet to muster effective policies to counter China’s supply chain strategy.